SPEEDUP TRADER

Speedup Trader provides traders with cash of up to $600,000. With over 40 platforms to connect to and free data offered, they are among the best in the business for futures funding in addition to forex trading. Speedup Trader is a New York-based prop company.

If you’re interested in knowing more about Speedup Trader and its fantastic 80% profit split, keep reading.

THIS ARTICLE HAS A DETAILED INFORMATION OF ALL YOU NEED TO KNOW ABOUT SPEEDUP TRADER, PROFIT SPLIT, MAXIMUM ALLOCATION, HOW TO BECOME A SPEEDUP FUNDED TRADER AND ALSO, ANSWERS TO FAQ’S.

About Speedup Trader

Speedup Trader is a prop firm that gives tools to traders to demonstrate your trading skills and comply with the rules. As a foreign broker, SpeedUp Trader offers up to 37 different future products for traders to choose from. You can trade using one of the three distinct types of accounts that are available.

Speedup Trader Account /Packages

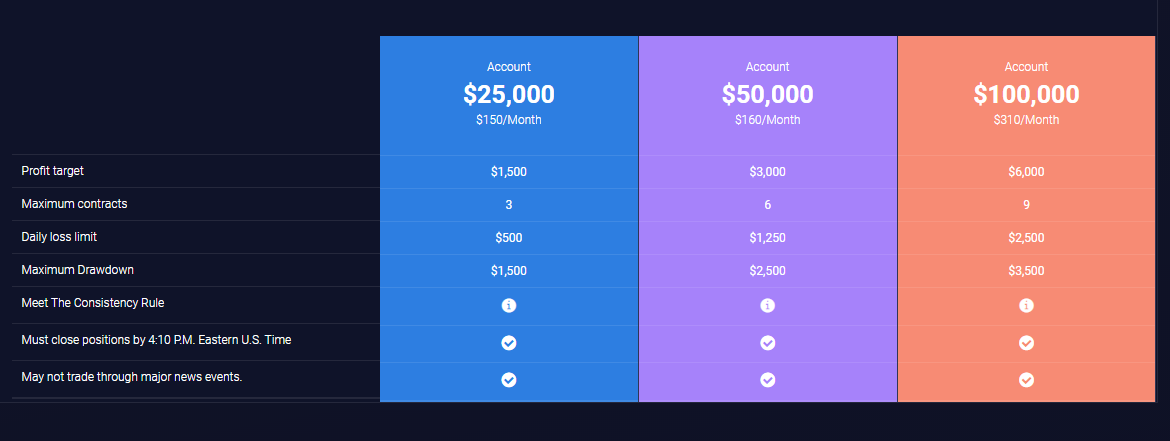

The speedup Trader has 3 funded account type, They are;

- $25,000

- $50,000

- $100,000

Note that your first $7,000 in profits are yours to keep, and 80% of your earnings after that. Take as much time as you need to attain your profit goal, but trade for at least 10 days.

Speedup Trader Account Sizes and Rules:

$25,000 Account

- -15 trading days minimum

- -$1,500 profit target

- -3 Contract maximum

- -Daily loss limit of $500

- -Maximum Drawdown of $1,500

- -Must close positions by 4:10 P.M. Eastern time.

- -May not trade through major news events.

$50,000 Account

- -15 trading days minimum

- -$3,000 profit target

- -6 Contract maximum

- -Daily loss limit of $1250

- -Maximum Drawdown of $2,500

- -Must close positions by 4:10 P.M. Eastern time.

- -May not trade through major news events.

$100,000 Account

- -15 trading days minimum

- -$6,000 profit target

- -9 Contract maximum

- -Daily loss limit of $2,500

- -Maximum Drawdown of $3,500

- -Must close positions by 4:10 P.M. Eastern time

- -May not trade through major news events

What Makes Speedup Trader Different From Other Prop Firms?

Although we have spoken briefly about them before, Speedup Trader has a few unique qualities that set it apart from other prop firms.

They connect to more than 40 trading platforms, so if you already have a favorite platform that you like to trade on, you should be able to continue using it with Speedup Trader. It can take some time to find the appropriate platform for you, so it’s encouraging for traders to know that they can continue trading in the same manner even if they switch services.

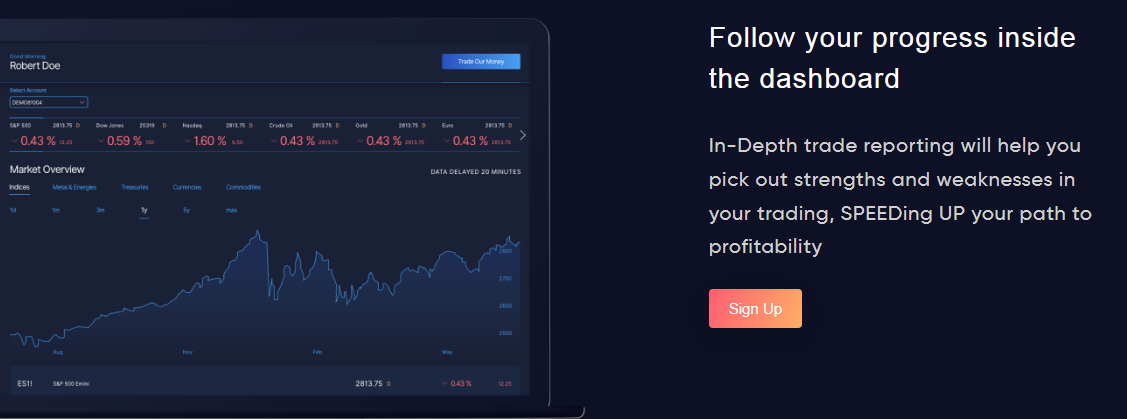

Their thorough account dashboard streamlines the procedure and offers a simple and accessible manner to trade.

Additionally they pay for your data when you trade, which is a huge bonus. Any data fees incurred while utilizing a US exchange have already been covered. But you have to pay for these markets if you trade EUREX. Since free market data is typically available, data isn’t a concern for forex spot traders, but it is for futures traders.

Speedup Trader FAQ’S

what’s next after a Successful Funding Tests:

Upon successful completion of a funding test, you are guaranteed access to a trading account. Then you can register and start trading.

How does the Funding process work?

SpeedUp Trader allows you to demonstrate your trading skills in compliance with the rules. Once you pass the test, they put you in touch with a different funding firm so you may practice trading in a real-world setting.

Does SpeedTrader accept foreign clients?

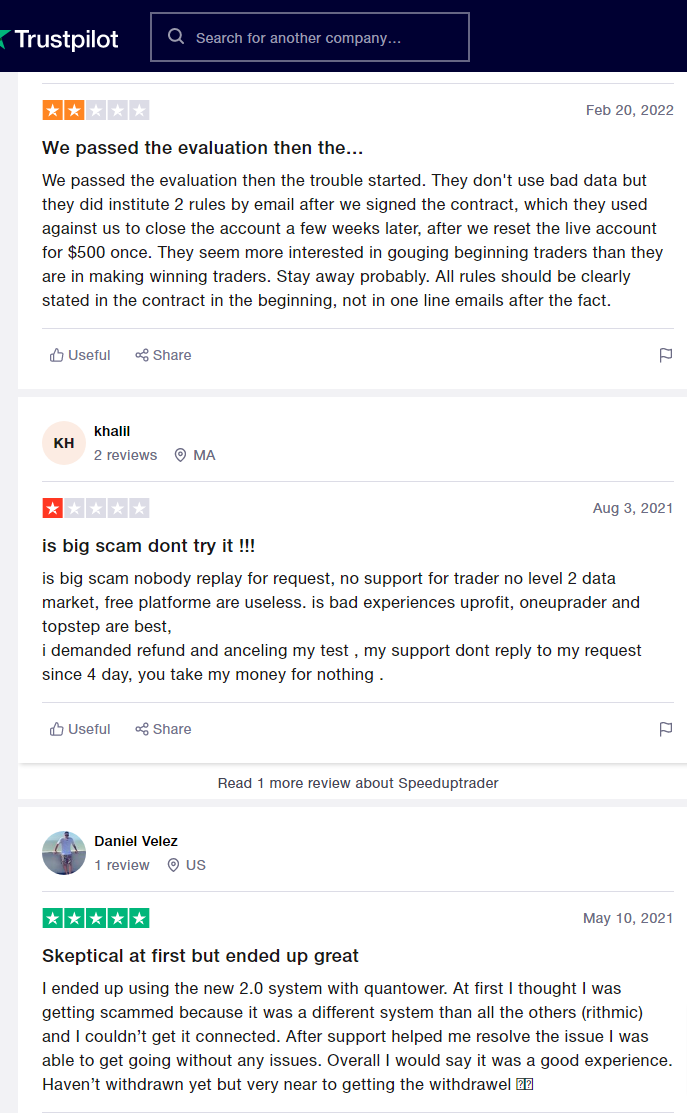

Speedup Trader Review

Here’s what Traders have to say concerning Speedup proprietary firm.

Is SpeedUp Trader Legit?

Since SpeedUp Trader is an offshore broker, it is not regulated. Additionally, the firm does not have a license.

Speedup Trader Contact

support@speeduptrader.com

99 Wall Street #235

New York, NY 10005