FINOTIVE FUNDING

Finotive Funding is one of the new prop firms in the industry with a renovative structure, plans, packages and a scaling program that runs up to a whopping 95% trader profit split. They also offer instant funding option that gets you to hit the ground running immediately!

This post contains everything you need to know about finotive funding prop firm, including: how to apply to become a finotive funded trader, their challenge and verification process, profit split, max allocated drawdown, and answers to some of the most popular questions.

Finotive Funding – Who They Are and What They Do?

Finotive Funding, the fourth division of the Finotive Group, was established in April 2021 and made its public debut on June 23 of that same year with a number of ground-breaking ideas that are expected to revolutionize the prop market.

“What revolutionary ideas? How do I get funded?” you ask? The answers to those and further questions are carefully documented below. Read on, will you?

How Do I Get Funded by Finotive Funding?

Getting funded isn’t any different from what to expect from the general prop market. A trader is simply expected to pass their challenge which comes at various prices for various account sizes, and there is also the option of Instant Funding.

First, the challenge is in two categories with clear targets that must be met. So, right on to the challenge, shall we?

READ: Prop Firm Evaluation Challenge Explained

Finotive Funding Challenge

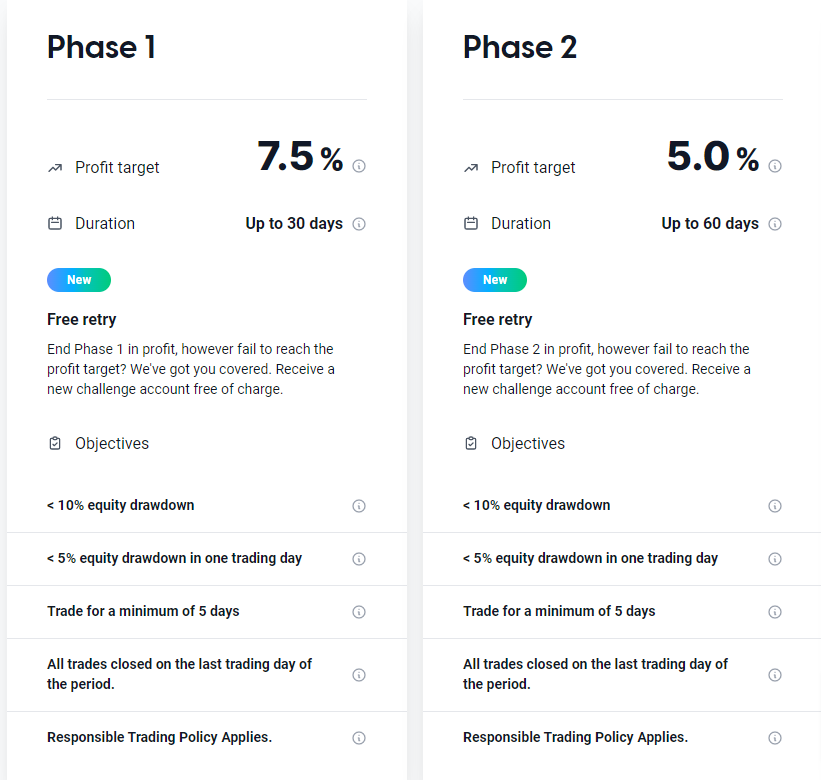

The challenge is in two phases with variations in the profit target, number of days and other details that we will be examining below:

Phase 1

In this phase, the profit-making skill of a trader is the main goal. Hence, trader is required to meet a 7.5% profit target in 30 days with a 5% equity drawdown in one day and an overall 10% equity drawdown.

Risk management is the key to successful trading, so to help you we have included some foundational risk parameters which must not be violated. While the profit target could be met earlier than the stipulated period, the trader must trade the account at least for a minimum of 5 days.

So what if you end the stipulated duration with some profit but fail to meet the profit target?

Not to worry, Finotive Funding has you covered. Having paid once, they will offer you a new challenge account with no cost attached. And that is one of their revolutionary policies that is quite uncommon compared to the general policies that operate in the wider prop market.

READ: Osprey Fx – Osprey Fx Society Prop Firm Profile [ Every Details Explained ]

Phase 2

In this phase, profit making is no longer the primary intention, but risk management. As a result, a trader is expected to make less profit in more days in contrast to what obtains in the first phase. The trader is expected to make 5% profit in 60 days with the same 5% equity drawdown in one day and an overall 10% equity drawdown that was maintain in Phase 1.

Also, you will be offered a free retry if your account at the end of 60days ends with some profit but fail to meet the stipulated profit target.

Here are the first two phases of the challenge at a simple glance

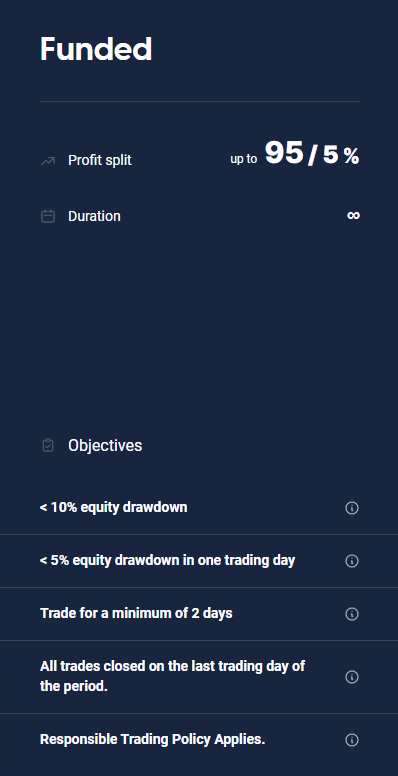

“So what happens next at the end of Phase 2” you ask? Good question!

You are rewarded with a funded account that matches the account size you paid for in the challenge. We’ll get to the account sizes and their pricing in a moment, but just before then, the rules for the funded account are not so divergent from the ones in the challenge phases. With same 5% equity drawdown in one day and an overall 10% equity drawdown that to be maintain, a trader is only meant to trade for a minimum of 2 days with no maximal duration and then rewarded with a whooping 95% profit split! Now that is what we’re talking about, R.E.V.O.L.U.T.I.O.N.A.R.Y!

Here is a glimpse of their funded account

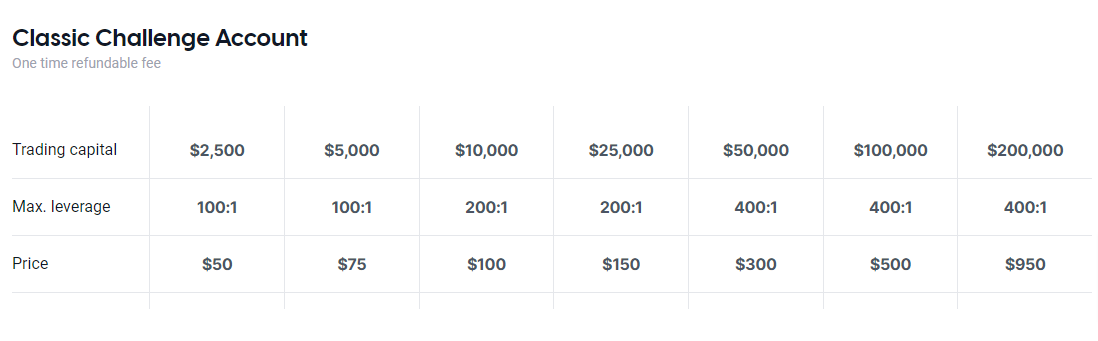

Finotive Funding Account Sizes

With all that’s been said of their challenge and revolutionary programs, what then is the pricing of their account? Coming up next.

READ: Earn 15% from The Evaluation Challenge with Fundednext

Finotive Funding Funded Account Pricing

Their funding accounts come in 7 different sizes at cheaper prices for as low as $50 dollars, another revolutionary policy aimed at accommodating the financial ability and trading styles of all intending traders and offer all equal chance at trading for an improved financial strength.

The Classic Challenge account prices are outlined below:

- A $2,500 account comes at a cost of $50

- A $5,000 account comes at a cost of $75

- A $10,000 account comes at a cost of $100

- A $25,000 account comes at a cost of $150

- A $50,000 account comes at a cost of $300

- A $100,000 account comes at a cost of $500

- A $200,000 account comes at a cost of $950

Finotive Instant funding

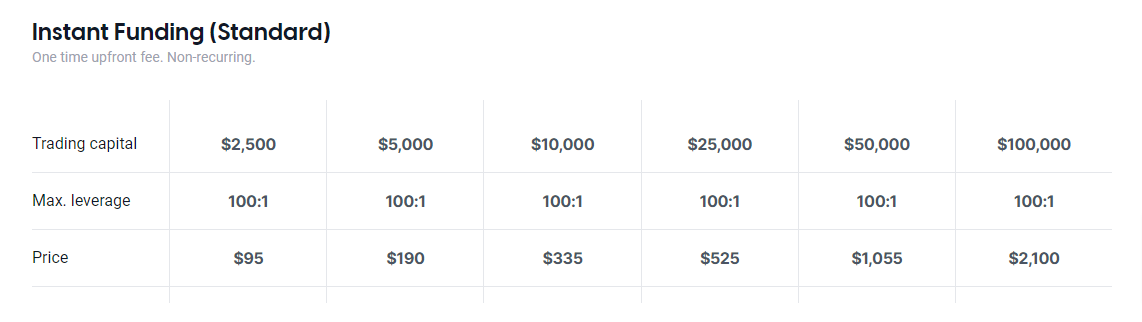

The Instant Funding Standard Challenge account prices are outlined below:

- A $2,500 account comes at a cost of $95

- A $5,000 account comes at a cost of $190

- A $10,000 account comes at a cost of $335

- A $20,000 account comes at a cost of $525

- A $50,000 account comes at a cost of $1,055

- A $100,000 account comes at a cost of $2,100

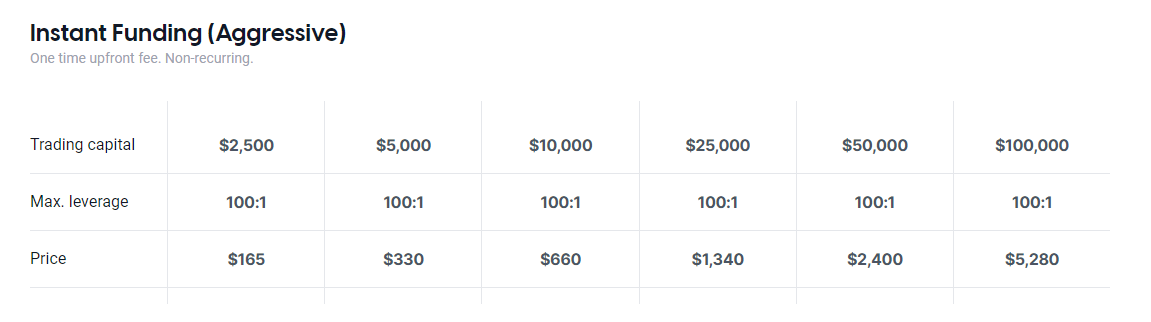

The Instant Funding Aggressive Challenge account prices are outlined below:

- A $2,500 account comes at a cost of $165

- A $5,000 account comes at a cost of $330

- A $10,000 account comes at a cost of $660

- A $20,000 account comes at a cost of $1,340

- A $50,000 account comes at a cost of $2,400

- A $100,000 account comes at a cost of $5,280

READ: 5%ERS: Important Things To Know About The 5ers Prop Firm

What is Finotive Funding Profit Split?

Finotive Funding offers a mouth watering profit split that scales up to 95% on their evaluation account. No firm in the current market has beaten that!

What Are Finotive Funding Trading Rules?

- The Trader must open at least one trade for at least 5 trading days. This is known as the Minimum Trading Days Rule.

- The daily and overall drawdown percentages must not be exceeded or the trader’s account will be terminated

- If the trader is inactive for 30 days from the time of progressing from Phase 1 to Phase 2, Finotive Funding reserves the right to suspend or terminate the

account without refunding the trader. - The Trader cannot experience trading losses for three months in a row.

It is highly recommended that intending traders really understand their trading rules, few of which have been highlighted above. For a comprehensive list of their trading rules, please click here

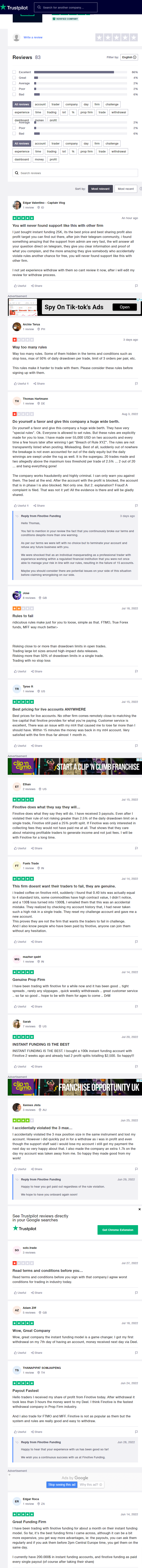

Is Finotive Funding A Scam Prop Firm?

With their Headquarters address at: FINOTIVE FUNDING KFT, Honvéd utca 8. 1st floor, 1054 Budapest, Hungary and Finotive Funding Kft as their parent company, in addition to what several traders had to say on the renown Trust Pilot, Finotive Funding is not a scam prop firm.

For further proof, here is their Company registration number as stated on their website: 01-09-384153 and Tax number: 29227091-2-41

Finotive Funding Reviews – what are Traders saying?

READ: Finotive Funding Review – An Unbiased Evaluation of the Prop Firm

READ: Finotive Funding Review – An Unbiased Evaluation of the Prop Firm

Finotive Funding FAQs

- Do you offer Leverage?

- What instruments can I trade?

- Can I hold trades over the weekend?

- Can I have more than one challenge?

- How do I get paid once I’m funded?

- Is there any restrictions on trading?

Trading Technology

They run their trading activities on the renowned Metatrader 4.

Education

They offer a detailed education to their traders via a PDF. It contains a careful stating of all their rules and trading terms and conditions. You can take a look or download it here

Payment Requirement

Finotive Funding Scaling Plan

Once the profit target is met in a funded account, traders have the option of either withdrawing their profit or using it to scale for a larger account which opens them up to a larger profit at the end of another successful trading on new account. The Scaling plan of the evaluation account varies from that of the Instant funding account.

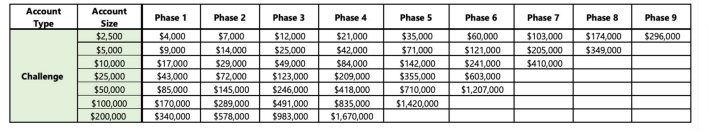

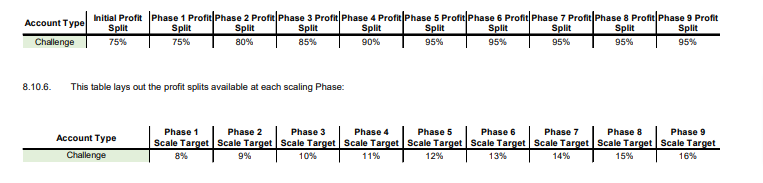

Below is an illustration of the scaling plan of the Evaluation Account in details.

The scaling requirement varies from one phase to another.

- An 8% profit target is required in phase 1 to scale to phase 2 with a 75% profit split

- A 9% profit target is required in phase 2 to scale to phase 3 with an 80% profit split

- A 10% profit target is required in phase 3 to scale to phase 4 with an 85% profit split

- An 11% profit target is required in phase 4 to scale to phase 5 with a 90% profit split

- A 12% profit target is required in phase 5 to scale to phase 6 with an optimum 95% profit split

- A 13% profit target is required in phase 6 to scale to phase 7 with an optimum 95% profit split

- A 14% profit target is required in phase 7 to scale to phase 8 with an optimum 95% profit split

- A 15% profit target is required in phase 8 to scale to phase 9 with an optimum 95% profit split

- A 16% profit target is required also in phase 9 which the apex phase.

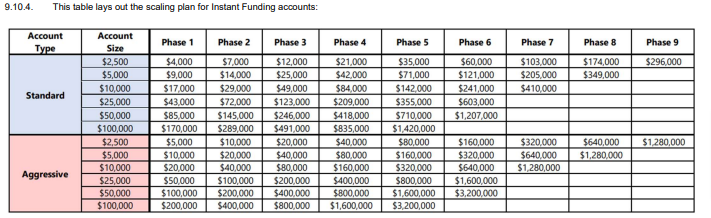

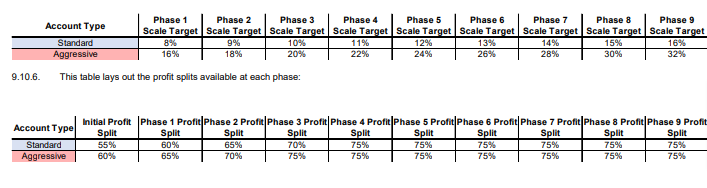

The Scaling plan for the Instant Funding is a little different from that of the evaluation account.

Below is the details of the scaling requirement of an Instant Funding Standard account

- An 8% profit target is required in phase 1 to scale to phase 2 with a 55% profit split

- A 9% profit target is required in phase 2 to scale to phase 3 with an 60% profit split

- A 10% profit target is required in phase 3 to scale to phase 4 with an 65% profit split

- An 11% profit target is required in phase 4 to scale to phase 5 with a 70% profit split

- A 12% profit target is required in phase 5 to scale to phase 6 with an optimum 75% profit split

- A 13% profit target is required in phase 6 to scale to phase 7 with an optimum 75% profit split

- A 14% profit target is required in phase 7 to scale to phase 8 with an optimum 75% profit split

- A 15% profit target is required in phase 8 to scale to phase 9 with an optimum 75% profit split

- A 16% profit target is required also in phase 9 which the apex phase.

Below is the details of the scaling requirement of an Instant Funding Aggressive account

- A 16% profit target is to be met in phase 1 to scale to phase 2 with a 60% profit split

- An 18% profit target is to be met in phase 2 to scale to phase 3 with a 65% profit split

- A 20% profit target is to be met in phase 3 to scale to phase 4 with a 70% profit split

- A 22% profit target is to be met in phase 4 to scale to phase 5 with an optimum 75% profit split

- A 24% profit target is to be met in phase 5 to scale to phase 6 with an optimum 75% profit split

- A 26% profit target is to be met in phase 6 to scale to phase 7 with an optimum 75% profit split

- A 28% profit target is to be met in phase 7 to scale to phase 8 with an optimum 75% profit split

- A 30% profit target is to be met in phase 8 to scale to phase 9 with an optimum 75% profit split

- A 32% profit target is to be met also in phase 9 which the apex phase.

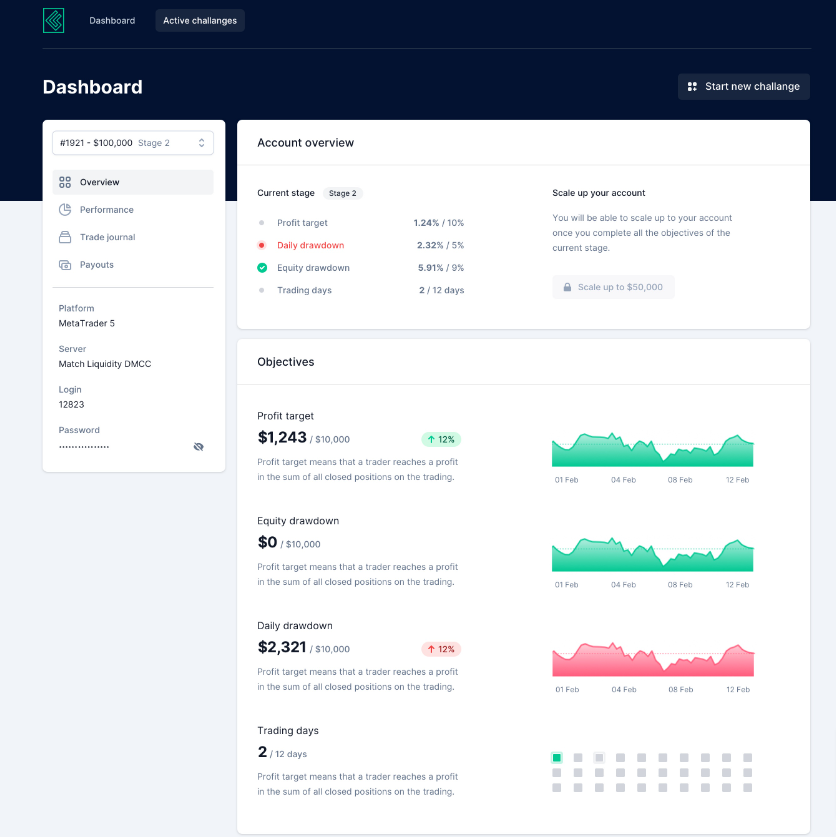

- Dashboard

- Contact

You can contact them through via their mail